In light of the successive collapses of the banks in USA, a deep crisis is looming in one of the world’s biggest economies, which will also affect the European Union countries.

US President Joe Biden said Monday that people should “rest assured” after his administration acted to ease uncertainties about the banking system in the wake of the collapse of Silicon Valley Bank last week.

The US president said the management of Silicon Valley Bank and Signature Bank, a second institution that was included in the plan, would be fired. “If the bank is taken over by FDIC, the people running the bank should not work there anymore,” he said.

Western Alliance shares also plummeted 80%, according to economic reports.

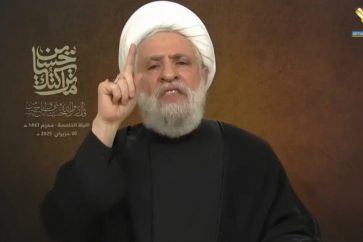

To explain the aspects of the US economic crisis, Al-Manar TV interviewed Dean of Business Administration Faculty at Maaref University, Professor Bassam Hamdar, who affirmed that stressed that the repercussions of real-estate crisis in 2008 have not ended yet.

Prof. Hamdar added that Obama administration was obliged to pump billions of dollars in the US economy in order to curb the repercussions, adding that the coronavirus pandemic contributed to the current crisis.

The expert explained that, during the pandemic, an amount of around 200 billion dollars was deposited by the customers in the United States in Silicon Valley Bank, adding that, however, the SVB could not invest them due to the closures.

Prof. Hamdar added that SVB purchased treasury bonds instead, noting that the economic crisis in the US whose inflation rates neared 7% led the administration to raise interests.

The professor pointed out that the interests rise diminished the value of the bonds, which led to a preliminary loss of 2 billion dollars suffered by SVB.

Prof. Hamdar highlighted the psychological role in exacerbating the crisis, explaining that depositors rushed to the bank in order to withdraw their funds, which led to the collapse.

Prof. Hamdar noted that President Biden’s claim that FDIC would compensate the losses is not accurate, adding that the insurance system in the US may cover the deposits which are below 250 thousand dollars exclusively.

The Lebanese expert indicated that the repercussions of the US banking crisis will reach Europe, citing cases of shares losses in Europe in Asia.

It is worth noting that around 500 Israeli high-tech companies deal with the Silicon Valley Bank’s branch in Tel Aviv which suddenly collapsed on Friday. So the bank’s fallout was immediate cause for concern in the Zionist entity.

Finally, Prof. Hamdar warned against the full dollarization of the Lebanese economy, adding that Lebanon would then be affected by all the monetary and economic crises that hit USA.

Lebanon has been already facing an unprecedented economic crisis with soaring inflation rates. The exchange rate of the Lebanese pound against teh US dollar has reached 97,000 L.L.

Source: Al-Manar English Website