French Economy Minister Bruno Le Maire on Tuesday promised a “strong” EU response to threatened US tariffs on French goods, as another front split open in the US trade war.

“We were in contact yesterday with the European Union to ensure that if there are new American tariffs there will be a European response, a strong response,” Le Maire told Radio Classique.

On Monday, the United States threatened to impose tariffs of up to 100 percent on $2.4 billion in French goods in retaliation for a digital services tax that Washington says is discriminatory.

The US and China are already embroiled in a trade war and US President Donald Trump said tariffs would be reinstated on Argentina and Brazil, accusing them of manipulating their currencies and hurting US farmers.

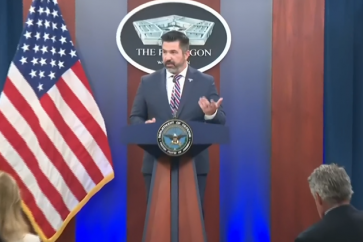

The decision “sends a clear signal that the United States will take action against digital tax regimes that discriminate or otherwise impose undue burdens on US companies,” US Trade Representative Robert Lighthizer said in a statement.

Le Maire told Radio Classique on Tuesday that the US threat was unacceptable.

“This is not the sort of behaviour one expects from the United States with respect to one of its main allies, France, and to Europe in general,” Le Maire said.

Lighthizer had also warned that Washington was considering widening the investigation to look into similar taxes in Austria, Italy and Turkey.

“The USTR is focused on countering the growing protectionism of EU member states, which unfairly targets US companies, whether through digital services taxes or other efforts that target leading US digital services companies,” he said.

The announcement came just hours before Trump is due to meet his French counterpart Emmanuel Macron on the sidelines of the NATO summit in London on Tuesday.

The French tax, enacted earlier this year, imposes a three percent levy on the revenues earned by technology firms in France, which often come from online advertising and other digital services.

The tax affects companies with at least 750 million euros ($830 million) in annual global revenue on their digital activities.

The French tax targets revenue instead of profits, which are often reported by tech giants in low-tax jurisdictions like Ireland in a practice that has enraged governments.

The USTR report “concluded that France’s Digital Services Tax (DST) discriminates against US companies, is inconsistent with prevailing principles of international tax policy, and is unusually burdensome for affected US companies”.

The USTR has scheduled public hearings on the proposal to impose “duties of up to 100 percent on certain French products” and the possibility of “imposing fees or restrictions on French services”.

The last date to submit comments on the proposed actions is January 14, and “USTR expects to proceed expeditiously thereafter”.

Source: AFP